Investor optimism continued this week, and financial markets maintained an upward trajectory. The S&P 500 finished the week up 4.9%, the technology-focused Nasdaq rose 3.4%, the small cap Russell 2000 advanced 8.0%, and international stocks, as represented by the MSCI ACWI Ex-USA, rose 7.2%. Investment-grade bonds, as measured by the Barclays U.S. Aggregate Bond Index, finished the week down 0.3%.

Major stock indices traded positively throughout the week due to (1) favorable sentiment about reopening and the pace of U.S. economic recovery, and (2) continued optimism about the development of a COVID-19 vaccine. U.S.–China relations were also a key theme this week, and we anticipate this will remain the case for the foreseeable future. Emerging markets had an especially strong week, receiving an extra boost by a weakening U.S. dollar. Friday’s surprisingly encouraging U.S. jobs report helped to cap the end of a strong week for global stocks. The U.S. economy added 2.5 million jobs in May versus the consensus forecast of a further loss of 7.5 million jobs. The U.S. unemployment rate fell to 13.3% in May, down from 14.7% in the prior month and much better than the consensus estimates for an increase in the rate to 19%.

The Pace of Economic Recovery

Progressive economic reopenings continued nationwide. Mobility data indicates that many major countries are on a similar recovery trajectory.

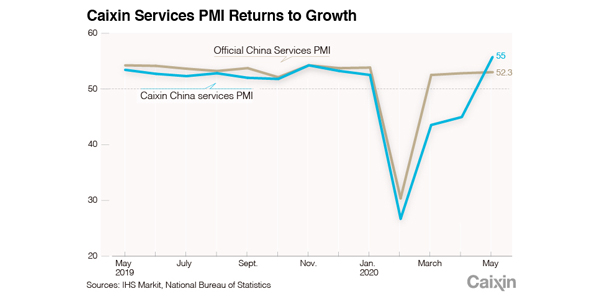

China seems to be recovering as its May oil consumption was more than 90% of pre-COVID levels, suggesting strong overall economic activity.[1] Additionally, the Purchasing Managers Index (PMI), which measures business activity and employment, shows that China’s service sector saw a V-shaped bottom in May. A reading of 50 means the country’s economy is exhibiting neutral or stabilized growth; above 50 reflects expansion, and below 50 reflects contraction. China’s General Services Index rebounded sharply from 44.4 in April to 55 in May, its highest level in nearly 10 years (see chart below).[2]

Vaccine Development

This week also brought encouraging news from NIAID Director Dr. Anthony Fauci. In a live Q&A broadcast with the Journal of the American Medical Association (JAMA), Dr. Fauci announced that the United States should have 100 million doses of a promising COVID-19 vaccine candidate by the end of the year, with a “couple hundred million” doses available in early 2021.[3] However, it’s still not clear whether the vaccine will be effective against the novel coronavirus.

Fauci said that the first vaccine candidate, the Moderna vaccine, is expected to begin Phase III testing (i.e., Phase III evaluates demonstrated effectiveness and an acceptable safety profile) by mid-summer. Studies on a “handful” of other vaccine candidates are also in the works and will begin in late summer or early autumn. There has been some concern that a recurrence of COVID-19 in the fall could potentially spark another economic downturn. Additional progress towards developing a vaccine will boost confidence in our country’s ability to navigate a possible second wave.

U.S. – China Relations

As we discussed in last week’s commentary, relations between the United States and China remain tense. The Trump administration announced a ban on Chinese passenger flights into and out of the U.S. on Wednesday in response to China’s refusal to allow U.S.-based carriers to resume normal operations in China. The action came on the heels of last week’s State Department announcement, which criticized China for repeated violations of Hong Kong’s autonomy.

The ongoing tension creates uncertainty around trade and normalization of travel between the two nations that could delay the progress of global economic recovery. The Trump administration’s response will not likely ease tensions between the two nations, however, in our opinion, it is unlikely to have any significant effects or jeopardize implementation of the Phase One trade deal.

All phases of the U.S. – China trade deal are not scheduled to be finalized until after the election in November. Our view is that any sign of strain on the deal is an incremental negative; however, barring a significant deterioration in relations between the two countries, the trade deal appears safe for now.

What This Means for Investors

Assuming the trade deal with China goes ahead as planned, progressive global economic recovery is likely. The S&P is only down 5.7% from pre-COVID levels on February 19, which reflects the forward-looking nature of the markets in the ongoing recovery and future corporate earnings.

There are risks that could potentially hinder the ongoing recovery, such as a second wave of COVID-19 cases before a viable vaccine is widely available, or further escalation of tensions between the U.S. and China. As we have mentioned throughout this COVID-induced recession, the stimulus packages provided by the federal government and Federal Reserve have helpfully cushioned the economy’s fall, although a fifth and likely final bill would cap off the efforts by providing needed state and municipal fiscal aid.

A return to normalcy will take some time, but we believe there are fundamental reasons that the markets and the economy will continue their recovery (e.g., mobility and spending data, upticks in manufacturing, better than expected earnings, and positive home sale trends), and reach normality over time. As always, our focus is on protecting and preserving our clients’ financial well-being, and we will continue to provide updates and offer guidance on new developments as they arise.

[1] Reuters, China drives global oil demand recovery out of coronavirus collapse.

[2] Caixin Global, Caixin PMI Shows Jump in Services Sector as Covid-19 Abates in China

[3] CNN, The US should have a “couple hundred million” doses of a Covid-19 vaccine by start of 2021, Fauci says.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.