We are all eager for information and useful advice during this unusual and volatile time. While current events are unprecedented, Sage has experience navigating worrisome markets and investor uncertainty, and we will continue to send more regular communications as long as it is appropriate.

Markets spiked higher yesterday, with the S&P 500 Index advancing 9.38% on news that the U.S. government officials were close to a bipartisan agreement on the terms of a fiscal stimulus package. Late last night, the White House and the Senate reached a tentative agreement on an approximately $2 trillion stimulus plan that the House will take up today. Global stocks surged. After days of bitter negotiations and public posturing, the agreement was a welcome sight for markets in search of good news. The question we are all asking is, what lies ahead?

One of the most important factors to weigh when determining the potential depth of economic contractions is bank health. Thanks to the Dodd-Frank regulation that followed the Global Financial Crisis, banks today are exceedingly healthy in terms of balance-sheet strength, capital ratios, and profitability.

Stock markets are forward-looking, and our current crisis is not a financial crisis, but a health crisis that has resulted in the cessation of economic activity. While the term “recession” can be scary to investors, and GDP predictions have been moving lower, if history is a guide, equities tend to bottom 3-6 months before economic activity pulls out of a recession. For example, the U.S. stock markets bottomed in March 2009, but the recession officially lasted until June 2009. We believe that in time, equity markets will start to factor in monetary and fiscal policy interventions, along with the likely success of the social distancing containment measures, and anticipate in their prices a recovery scenario. What we are experiencing now is the process of stock markets pricing in the recession that is now widely anticipated to occur in 2020. We have not finished Q1, but this is itself evidence that markets tend to look ahead. We believe that they will eventually also look ahead to the path of recovery.

In this communication, we want to outline the three topics that Sage believes financial markets seek clarity on as central catalysts for a turnaround: (1) central bank monetary policy, (2) government fiscal policy, and (3) biology.

Monetary Policy

For lack of a more appropriate term, the Federal Reserve has brought out the bazooka. It has gone all-in to provide whatever monetary support the United States needs during this pandemic. Chairman Powell has indicated the Fed will do whatever it can to pad the economy and keep liquidity in the market during the period of social distancing and stay-at-home orders. To start, the Fed has initiated a slew of major actions to help bolster liquidity, including the significant step of announcing that its QE program is now open-ended. Previously the Fed said it would buy $700 billion total in Treasuries and mortgage-backed securities. Now it says it will buy “however much is required.” It will also begin purchasing commercial mortgage-backed securities, and provide support for corporate bonds and credit facilities for small businesses and consumer credit. We view these actions, coupled with extremely low-interest, as extremely bold and large enough to help make a critical difference when paired with fiscal policy.

Other global central banks have acted decisively as well. Last week, the ECB announced a €750 billion stimulus program to provide liquidity to financial markets and attempt to soften the economic slowdown.

Fiscal Policy

The tentative agreement reached late last night by the White House and the Senate is for an approximately $2 trillion stimulus plan to help workers and businesses in affected industries (restaurants, airlines, hotels, etc.) and citizens in general (via cash payments over the next two months of $1,200 for adults who are under certain income levels and $500 available for children). The legislation will continue to be hammered out this morning by the Senate and probably will be passed later today. The House has promised to take up the bill shortly thereafter. Although actual passage and presidential signing remain a day or so away, this is a major and much-needed breakthrough. The U.S. had an annual GDP of $21.4 trillion in 2019, making this $2 trillion stimulus a significant boost equivalent to nearly 10% of GDP.

Progress in negotiations yesterday between House Speaker Pelosi and Senate Leader McConnell was the main driver of the sharp rise in equity markets. Although this bill still must go through a few steps before becoming law, we believe that passage is assured and that this fiscal stimulus package will help pad the pain of the downturn. Moreover, it will give households, businesses, and investors hope that they can survive the economic shutdown.

Biology

Biology is important to the investment outlook because the extent of virus transmission, the path for promising vaccines and treatments, and the duration of the need for social distancing and economic cessation directly bear on market expectations for corporate health and profitability. With this in mind, it is encouraging that there have been positive developments in terms of potential new medicines under study and actual cases of some countries containing the virus.

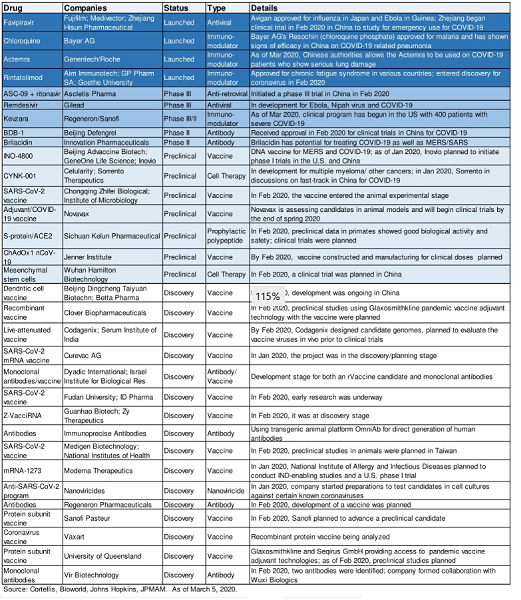

In the last week, there has been some positive news about possible treatments and vaccines that are under clinical trials in various regions. While we have no way of knowing which of these treatments, if any, may be successful or potentially approved for widescale use, we want to share some of the specifics of the research that is underway. The table below of drug types was culled from leading global health data sources, including Johns Hopkins and others.

These drugs may not be available for immediate, wide-scale use beyond various trials, but the promise that they exist and may help may be enough to help markets have hope that ultimately the virus is not going to win. The amount of talent and resources devoted to addressing both the virus and the disease is something that has not been seen since World War II, and it seems that there is room for progress to be made in the coming weeks.

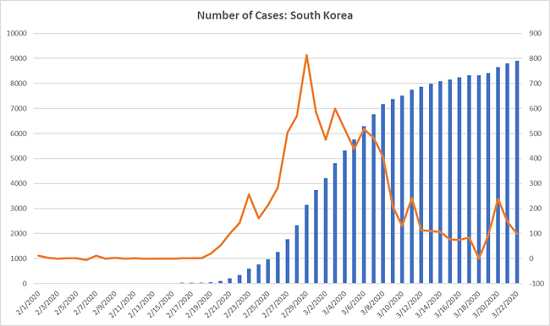

Infection numbers and trends are also extremely important, and something we are monitoring closely. South Korea has been the model for how a country can contain the virus within 4-6 weeks. The chart below shows the number of total cases in blue and the number of new cases in orange. As shown, the number of new cases peaked in late February (source: WHO). When the number of new cases peaks, the fear of exponential infection subsides.

The controls that South Korea took have been the playbook for other nations: widespread drive-through testing centers and social distancing. Testing is critically important in understanding the virus, and many countries have been slow to pick this up. However, Italy has just recorded two straight days of fewer new infections. The U.S. is likely a week or two away from this point, but we believe that it is possible that a peak in new cases may occur sooner than some current market expectations.

Overall, we continue to think that the duration and depth of the financial slowdown will depend on a combination of the policy response from governments and central banks, public/investor sentiment, and the success of current virus mitigation methods. The current market dislocation is a reflection of an anticipated economic slowdown along with the uncertainty and suddenness of the slowdown we are experiencing. While there is ample bad news ahead of us (including higher confirmed virus cases, significant negative revisions to GDP growth and corporate earnings, a spike in unemployment claims, etc.), the market is forward-looking and has moved lower already in anticipation of these “expected” events. If there is further deterioration to the outlook, markets will react accordingly, and we tend to think that equities are pricing in more of the potential negative scenarios than the potential positive developments.

Any projections, market outlooks, or estimates in this letter are forward-looking statements that are based upon certain assumptions that may not be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Past performance may not be indicative of future results. The information contained in this newsletter is not intended to serve as personalized investment advice. You are encouraged to consult with your Sage Financial Group advisor or a professional advisor of your choosing to determine the applicability of this discussion to your individual situation.