In this edition of Insights, we explore two key themes shaping today’s investment landscape:

- Ongoing trade agreements are creating a new framework for the global economy.

- U.S. corporate earnings are exceeding initial expectations, despite economic policy uncertainty.

Monthly Market Wrap

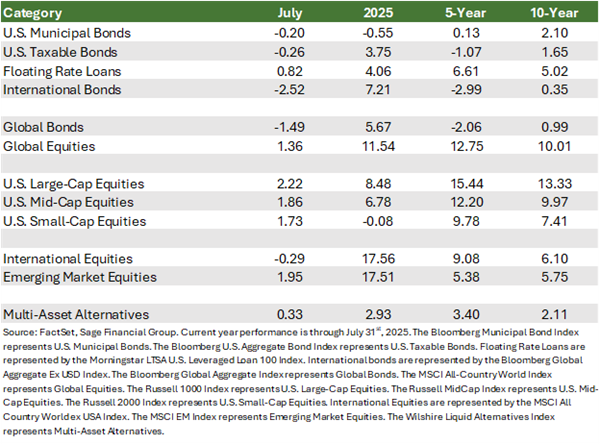

The financial markets delivered mixed results in July. U.S. equities extended their upward trend, supported by strong corporate earnings and improved trade clarity. Meanwhile, rising interest rates weighed on fixed income returns, creating headwinds for bond investors.

Fixed Income Markets

- Global Bonds declined 1.5%, driven by stronger-than-expected economic data and fiscal uncertainty that pushed yields higher and prices lower across major markets.

- U.S. Taxable Bonds fell 0.3% as improved economic growth contributed to rising Treasury yields.

- U.S. Tax-Exempt Bonds declined 0.2%, with a record-breaking wave of new municipal bond issuance outpacing investor demand.

- Floating-Rate Loans added 0.8% due to their natural hedge against rising interest rates, elevated yields, and inflation uncertainty.

- International Bonds dropped 2.5%, with sharp yield increases in Japan and the U.K. amid rising investor concern over large fiscal deficits.

Equity Markets

- Global Equities advanced 1.4%, as easing tariff uncertainty lifted sentiment and encouraged broad gains.

- U.S. Large-Cap Equities led the way with a 2.2% gain, driven by strong earnings reports, particularly among mega-cap technology companies.

- U.S. Mid- and Small-Cap Equities rose 1.9% and 1.7% respectively, supported by continued economic resilience and investor optimism around potential rate cuts in the Fall.

- International Equities dipped 0.3% as investors reacted cautiously to the newly agreed-upon 15% tariff on most EU and Japanese goods. While viewed primarily as a compromise, the outcomes still introduced some uncertainty.

- Emerging Market Equities gained 2.0%, buoyed by reported progress in U.S.-China trade negotiations and a plan to extend the current truce through mid-August.

Year-to-date, international and emerging market equities have been top performers, each up roughly 17.5%. For investors, we continue to believe this broad-based strength reinforces the value of global diversification as a strategy to participate in growth while helping cushion against uncertainty.

A New Framework for Global Trade

Major tariff agreements finalized in July marked a significant shift in global trade dynamics. Most notably, the U.S. and the European Union reached a broad deal just ahead of a looming August 1 deadline, setting a new phase in international economic relations.

The agreement capped most EU goods imported into the U.S. at a 15% tariff, down from the 30% that had been threatened. Affected goods include automobiles, pharmaceuticals, and semiconductors. While this rate is still considerably higher than the pre-2025 average, it reflects a meaningful de-escalation in trade tensions.

In exchange for this tariff reduction on most goods, the EU agreed to:

- Significant purchases of U.S. energy products, totaling an estimated $750 billion worth of U.S. liquefied natural gas, oil, and nuclear fuels over the next three years.

- $600 billion in new investments in the U.S., targeting key areas such as manufacturing, energy infrastructure, and defense.

Beyond Europe, the U.S. also made progress with Japan, Indonesia, and the Philippines, finalizing framework agreements that involve elevated tariffs in exchange for expanded access to American markets. However, broad agreements with two of the largest trading partners, Mexico and China, remain unsettled, with ongoing talks scheduled.

Some tariffs remain in place, notably the 50% duties on steel and aluminum imports for most countries, though tariff rate quotas have been established for EU steel and aluminum exports.

What It Means for Investors

In our view, the tariff-driven pause in Federal Reserve policy will likely abate over the coming months as rate cutting begins, though uncertainty may still present headwinds for both bonds and stocks in the near term.

While complex, we believe the broader direction is constructive: reduced friction and increased cross-border investment can support global supply chains, capital spending, and long-term corporate earnings growth.

Corporate Earnings Kick Off Q2 with Strong Beats

Despite economic headwinds and policy uncertainties, U.S. corporate earnings for the second quarter of 2025 have been stronger than expected, providing another important source of support for equity markets.

Over half of S&P 500 companies have reported Q2 results, and 80% have exceeded analyst expectations for earnings per share (EPS) growth. While earnings growth has moderated from Q1’s pace, the overall trend remains positive:

- The blended year-over-year growth rate for the S&P 500 stands at 6.8%.

- This follows 11% growth in Q1 and marks the eighth consecutive quarter of positive year-over-year earnings growth.

Sector Highlights and Earnings Themes

Several sectors stood out this quarter, continuing to drive market momentum:

- Technology and communication services remain key engines of earnings growth, fueled by strong demand for AI-related products and services and AI infrastructure investments by large-scale providers (“Hyperscalers”).

- Financials had a powerful start to the earnings season, with major banks benefiting from continued loan growth, deposit stability, and healthy investment banking activity. They consistently beat consensus estimates for both revenue and earnings.

- Operational resilience has also been a theme, with many companies effectively navigating challenges like elevated interest rates, tariff uncertainty, and a softening labor market. The initial fears of significant economic strain from recent trade policy changes have so far proven overblown, thanks in part to strategic inventory management and cost-absorption efforts.

At this time, the consensus expectation is for continued earnings growth through the second half of 2025 and possible re-acceleration in 2026. This ongoing strength in corporate earnings has driven recent equity performance, supporting U.S. stocks and credit-sensitive investments such as floating-rate loans and alternative asset classes like private equity.

Closing Thoughts

While July delivered strong market performance, we remain mindful of the uncertainties ahead—including monetary policy decisions, a busy political calendar, and persistent global tension. That said, encouraging signs are emerging beneath the surface.

Corporate earnings are holding up, trade tensions are easing, and innovation continues to move forward. On the other hand, weaker employment numbers and sporadic inflation are dampening the positive news.

Periods like this remind us that broad, long-term progress often happens behind the headlines and beyond the noise.

Our focus remains on helping our clients stay focused on what is most relevant to them – their goals, time horizon, liquidity needs, risk tolerance, and unique circumstances.

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’s written disclosure statement discussing our advisory services and fees is available for review upon request.